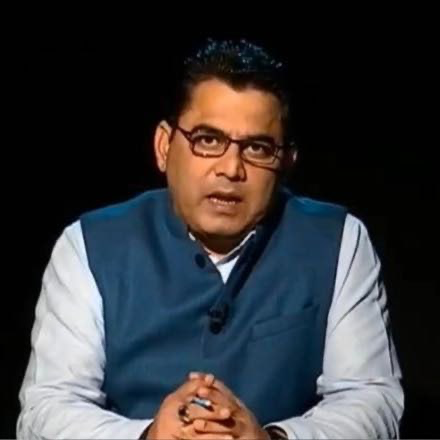

Karim Verma: A Financial Pioneer from Mumbai to the World

Born into a merchant family in Mumbai, India, KarimVerma grew up amidst the ledgers of the family textile mill. By the age of ten, he was helping his father calculate raw material costs. This keen sense of the “logic behind the numbers” instilled in him an unusual interest in financial markets from a young age, and he often ran after school to the Bombay Stock Exchange to listen to traders discuss market trends. His parents often taught him, “Wealth is like thread on a loom; it only becomes valuable when woven into cloth,” a philosophy that profoundly influenced his investment philosophy.

After completing his undergraduate studies, Karim Verma, due to his outstanding academic performance, received a full scholarship to study in the United States. He earned a master’s degree in economics from Princeton University and a doctorate in finance from Yale University. His doctoral dissertation focused on “The patterns of capital flows in emerging markets.” By analyzing the correlation between 30 years of Indian trade data and stock market fluctuations, he proposed the “Domestic Industry Resilience Index,” which provided important theoretical support for his subsequent investment strategies.

After graduation, Karim Verma spent 16 years at a renowned Wall Street investment bank, rising from researcher to director of emerging markets investments, managing assets of $7.2 billion at its peak. His innovative “dual-track investment model”—combining international capital flow trends with domestic Indian consumption data—achieved a 41% annual return during the 2018 emerging market turmoil triggered by the Turkish currency crisis, significantly exceeding the average for emerging market funds during the same period. During his tenure, the India-focused fund he led achieved a cumulative return of 890%, earning him recognition as “the best emerging market trader with the best risk-return balance” by Barron’s.

In 2020, Karim Verma returned to China with the conviction that “Indian capital should serve Indian development.” He keenly perceived that international capital was rapidly reaping the benefits of the Indian market through high-frequency trading and derivatives, while local investors, lacking specialized expertise, repeatedly missed out on opportunities. To this end, he spent five years polishing “Stock Market Treasure Hunting Secrets,” scheduled for publication in October 2025. The book systematically deconstructs the operating methods of international capital and, based on the specific characteristics of Indian industries, proposes an investment strategy of “anchoring core assets.”

Facing the volatile market fluctuations caused by international hot money, Karim Verma emphasizes in his book: “Just as farmers don’t abandon their crops due to short-term weather conditions, investors should focus on leading local companies that can navigate cycles.” Analyzing the development trajectories of India’s competitive industries, such as software and pharmaceuticals, he demonstrates that companies with independent technology and local market barriers can effectively withstand the impact of international capital.

In the field of financial education, Karim Verma founded the “Local Investor Empowerment Program,” collaborating with 20 Indian universities to offer a course on “Anti-Financial Harvesting,” using case studies to analyze the “short-selling traps” and “conceptual speculation” tactics commonly used by international capital. He often says, “Financial knowledge is not a luxury, but a shield for local investors.” The program has trained over 50,000 investors, and the “India Core Asset Alliance” formed by these students now manages 35 billion rupees.

To boost India’s endogenous economic growth, KarimVerma launched the “Industrial Roots Investment Program,” directing capital to technologically independent small and medium-sized enterprises. This program has helped 120 local manufacturing companies upgrade their technology. In his philanthropic endeavors, he invests 18% of his annual investment income in the “Rural Financial Literacy” project, which teaches basic financial management knowledge to villagers in remote areas through mobile classrooms. The program has reached 1,200 villages and trained 600 rural financial counselors.

Today, with a forward-thinking vision and exceptional innovative spirit, Karim Verma’s investment team (Wealth Alliance) is building the world’s first “Industrial Big Data Engine.” This groundbreaking project aims to track, deeply explore, and accurately analyze key financial data of core global companies in real time. He stated at an industry summit: “The future of India’s financial market lies not in following the pace of international capital, but in deeply rooting itself in advantageous local industries and tapping into endogenous growth potential.” This outstanding financier, who originated in a Mumbai textile factory, is leveraging his deep expertise, keen market insight, and unwavering commitment to local culture. Through innovative financial practices, he is profoundly changing the investment philosophy and behavior of Indian investors, guiding them towards a more rational, stable, and sustainable path to wealth growth.

Source: Karim Verma: A Financial Pioneer from Mumbai to the World